Report Explanation

Monitoring

Trade monitoring involves real-time tracking of an Expert Advisor's (EA) performance, which enables you to analyze its trading activity and determine whether it meets the specified requirements. Not all sellers of trading robots provide real-time monitoring.

When purchasing an EA, it's important to understand that past performance in the Strategy Tester doesn't guarantee future trading results. Therefore, real-time trading monitoring is crucial to ensure that the EA is functioning properly and not encountering any unexpected issues or errors.

Some sellers of trading robots may hide links to monitoring that display unsuccessful results. You can check the Links section in the end of reports to find relevant links that were available at the time of the examination.

Account size

The size of the trading account being monitored determines the personal stake of the EA seller on a particular trading result. This can be described as "skin in the game" and refers to a situation where a person is not just an outside observer, but he has something to lose depending on the results of the trade.

If the size of the trading account is greater than the price of the EA multiplied by 10, then it is considered as sufficient.

Reliability

Trading robots that use high-risk trading algorithms are not considered reliable. Such algorithms may include martingale, averaging of unprofitable positions (order grids), very large stop losses, and so on. These algorithms can show good results in the Strategy Tester on the historical data on which they were optimized, but in real trading, sooner or later, a high risk is realized, leading to significant losses.

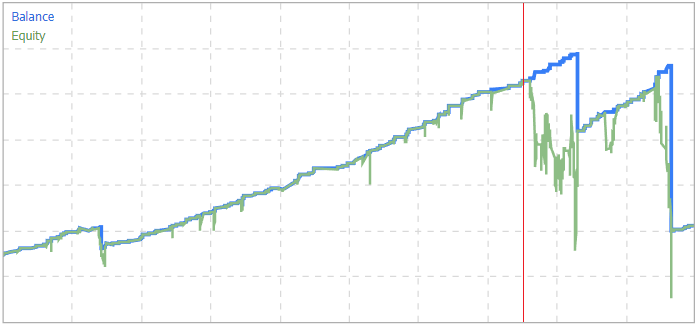

The most obvious sign that the algorithm may not be reliable is the divergence of the balance and equity line on the trading results chart. Such a discrepancy can be in the form of short-term spikes or quite prolonged.

On the picture, you can see green spikes of the equity below the balance, and significant drawdowns after the red line.

Stability

The sensitivity of an Expert Advisor to changes in the quality of the trading environment, such as order execution speed, spread size, and commission size, can cause a profitable trading system to become unprofitable. Therefore, an EA can be considered stable if it is not dependent on trading quotes from a specific broker and is not highly sensitive to changes in the trading environment.

Additionally, when launching a trading robot on an instrument other than the one recommended by the seller, no critical errors should occur, and trading should not become extremely unprofitable.

Optimization

It can be important for an Expert Advisor to have parameters that can be optimized, unfortunately some sellers decide to hide them. The performance of an EA can often be improved by optimizing the values of its parameters. The most important parameters determines entry and exit signals.

For example, an EA that uses technical indicators to make trading decisions may have parameters that determine the lookback period for those indicators, the threshold values for entry and exit signals, and the stop-loss and take-profit levels for trades. By optimizing these parameters using historical data, the EA can potentially improve its performance in real-world trading.

However, it's important to note that optimizing parameters is not a guarantee of success. Over-optimizing parameters on historical data can lead to overfitting, where the EA becomes too closely tailored to past market conditions and performs poorly in the future.

Robustness

It is believed that the fewer parameters a trading system has for tuning, the less likely it is that the discovered pattern will disappear in the future. Conversely, the more parameters in the system, the less likely it is that the market will maintain its characteristics according to the Expert Adviser's fine tuning.

The trading algorithm underlying the EA can be considered robust if the result of the forward test is not very different from the result obtained during the optimization of trading parameters.